OvOpapi N1ckms

Badman

Kaartjes vanaf 750,- srd

Shows

vr – 20:00 (start show)

Uitverkocht

za – 20:00 (start show)

Uitverkocht

zo – 20:00 (start show)

Uitverkocht

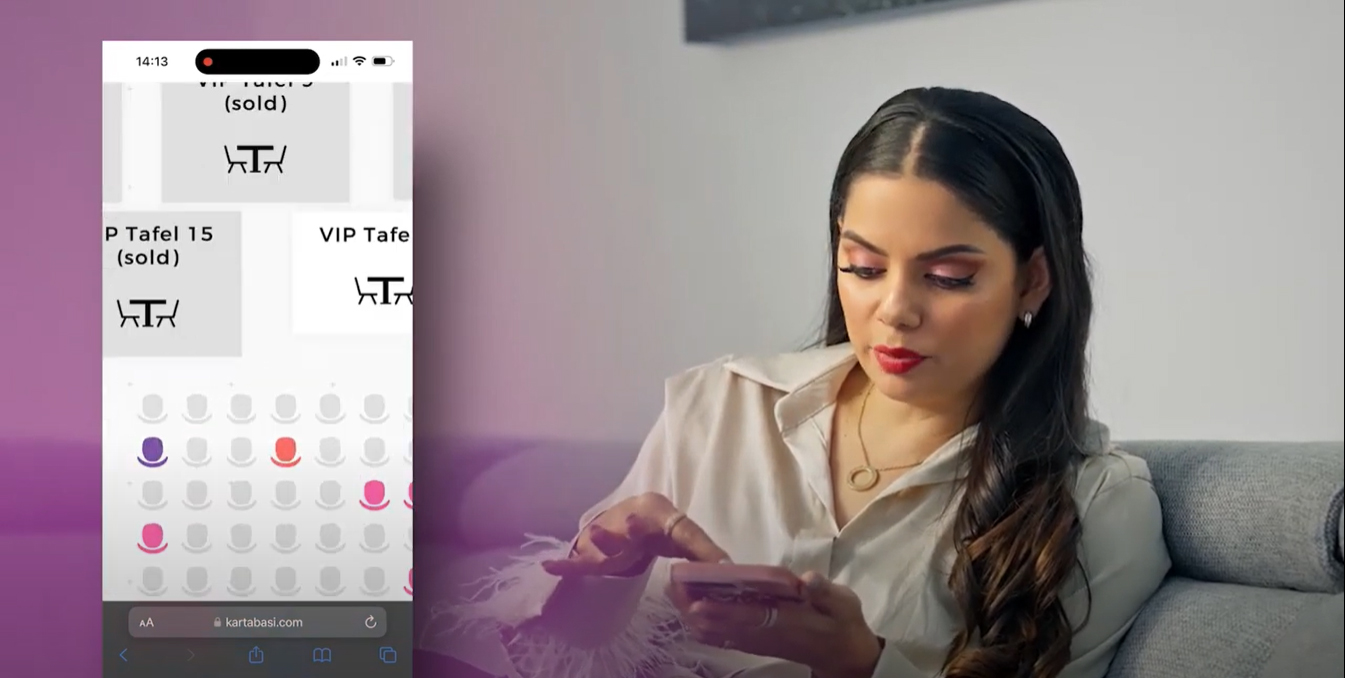

Hoe koop ik een kaart?

Bekijk het filmpje om alles te weten te komen over het bestelproces.

Digitale kaarten

Bij Kartabasi maken wij gebruik van digitale kaarten! Je krijgt dus geen fysieke kaarten meer. Er zijn 3 soorten digitale kaarten: PDF, Apple Wallet Pass en Android Wallet Pass.

Bankoverschrijving

Cash/pin

VIP Reserveringen

Snew Seat

-

Cosy bank voor 2 personen

-

Valet service (1 auto)

-

Snackplatter voor 2

-

Custom Badman shot

-

2 rondjes on the house

VIP TAFEL

-

Tafel met arrangement voor 5 personen

-

Valet service (max. 2 auto's)

-

Fingerfoods, lichte maaltijd en dessert

-

Custom Badman shot

-

Drankenpakket (alcoholisch en non-alcoholisch)

VIP reserveringen kunnen vanaf 19 september 2023 geplaatst worden via

Over OvOpapi N1ckms

OvOpapi N1ckms is doorgebroken op social media met zijn online sketches over actuele onderwerpen uit de Surinaamse cultuur. Al snel hebben de personages in zijn sketches de online harten van jong en ouder publiek veroverd. Sinds ongeveer een jaar deelt Nickms zijn humoristische kijk op het leven ook on stage in Nederland waar hij al ongeveer 5 jaar woont en studeert. Na onder andere in het voorprogramma van Roue Verveer te hebben gestaan, toont Nickms vanaf februari 2023 zijn kunnen in zijn eigen shows door heel Nederland. In september debuteert Nickms zijn show Badman in Nederland. De première van de show in Theater Zuidplein in Rotterdam is zijn grootste tot nu toe… de kaarten daarvoor waren binnen 3 dagen uitverkocht.

Je weet hoe Badman denkt...hij denkt niet!

In oktober zijn de vele fans in Suriname aan de beurt. Ovopapi Nickms kan niet wachten tot hij thuis op het podium staat. Er is veel te vertellen en genoeg te beleven. En wees voorbereid: Badman maakt natuurlijk een appearance. En je weet hoe Badman denkt… hij denkt niet!

Badman komt naar SU!

De sponsors & partners die alles mogelijk maken!

Sponsors

Partners

The Snew kids on the block!

Who that?

Fanisha, Ferranto en Raoul zijn vrienden met liefde voor Suriname en een passie voor cultuur, entertainment en comedy. Ze kwamen met het Snew (uitspraak: snieuw) idee om events in Suriname ietsjes anders aan te pakken.

De Snew KIDS hebben samen een track record van 40+ jaren (in en buiten Suriname) op het gebied van:

- Event concepting

- Event planning & uitvoer

- Dienstverlening

- Marketing

- Online oplossingen

Wanna be starting snewing something

“Badman” is de tweede show van Snew Productions onder het thema:

Stand-Up in Su!

Met de eerste show: ‘We gaan kwijt in Su’ heeft Snew in augustus 2023 een nieuwe standaard gezet in de evenementenwereld in Suriname.

And baby, we’re just getting started!

This site uses cookies. Find out more about cookies and how you can refuse them.